Information

- Policy Theme: Enhancing Rural Livelihoods & Natural Capital

- Country: Colombia

- Project date: December, 2020

- Project URL: Access the full paper here

Overview

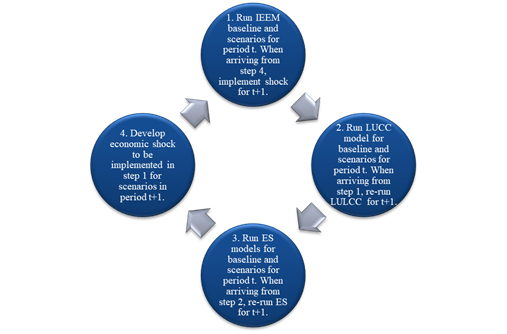

In post-conflict Colombia, the Government has prioritized resettlement of displaced people through development of strong rural livelihoods and the sustainable use of natural capital. We consider Government proposals for expanding payment for ecosystem services and sustainable silvopastoral systems, and private-sector investment in habitat banking. We coupled IEEM with spatially explicit land use land cover change and ecosystem services models (IEEM+ESM) to assess the potential impacts of these programs through the lens of wealth and sustainable economic development. This innovative workflow (Figure 1) integrates dynamic endogenous feedbacks between natural capital, ecosystem services and the economic system. In this workflow, agents in IEEM are confronted with changes in ecosystem service supply on a periodic basis and has a result, adjust their behavior. A byproduct of this approach is that an estimate of the economic value of ecosystem services is generated, all consistent and compatible with a country’s System of National Accounts.

Scenarios and Results

We designed five scenarios to assess Colombian government and private sector plans to strengthen rural livelihood opportunities and enhance natural capital and ecosystem service flows. In IEEM+ESM, we implement a baseline projection of the economy and 4 scenarios for the analytical period 2020 to 2040. The baseline (BASE) scenario projects the economy to 2040 based on projections of GDP and population and represents the reference scenario to which all other scenarios are compared. A Payment for Ecosystem Services (PES) scenario simulates the establishment of 500,000 hectares (ha) of PES for strict preservation. A Sustainable Silvopastoral Systems (SPS) scenario simulates the restoration of 125,000 ha of degraded pasture areas with more productive silvopastoral systems. The COMBI scenario is the joint implementation of the PES and SPS scenarios. A variation of the COMBI scenario is the PES and endogenous estimation of livestock Total Factor Productivity (PES+SPSe) scenario which simulates the establishment of 500,000 ha of PES and endogenizes livestock productivity such that the scenario is GDP neutral. Finally, a Habitat Bank scenario (HAB) simulates the expansion of 500,000 ha of Colombia’s habitat banking system where 80% of this area would be designated as strict preservation of existing intact ecosystems and 20% would involve restoration of degraded ecosystems.

First, in terms of impacts on land use land cover change, the main driver of change in Colombia is the conversion of forest to grazing land to meet growing demand for land, particularly along the Amazon Forest frontier. Although this is the predominant process of forest loss that we observed in our scenarios, we also observed some conversion of forests to grazing land near roads but far from the forest edge, for example, in the department of Amazonas. Encroachment of cropland into forests is more common in the Pacific regions.

At the national level by 2040, PES and HAB would enhance erosion mitigation ecosystem services while SPS and COMBI reduce these services (by 3.3%, 16.7%, 12.5% and 4%, respectively), due to different shares of cropland and grassland. Impacts, however, are spatially heterogenous. Even in the PES scenario, some Departments would experience a reduction in erosion mitigation services. All scenarios would result in increased carbon storage, with the HAB and PES+SPSe scenarios showing the greatest increase (7.2% and 6.8%, respectively). Overall, all scenarios except SPS would increase water purification ecosystem services with HAB outperforming others in terms of increases in both nitrogen and phosphorus retention (29.4% and 18.8%, respectively). Relative to business-as-usual, all scenarios would result in greater evapotranspiration, benefitting Colombia’s hydrological systems. This would result in less water runoff, thus reducing the impacts of floods, while maintaining better water quality and more water for dry-season flows. Compared to the BASE, improvements to water regulation in other scenarios would range from 0.6% in SPS, to 6.4% in the PES scenario.

The economic impact of policy implementation varied with the inclusion of ecosystem service values. When ecosystem service values are not included, the PES scenario would generate competition for crop and livestock land and would result in a US$262 million decline in GDP. With the importance of agriculture to the incomes of many rural households, household consumption would contract by US$188 million; despite the policy’s positive impact on natural capital, the decline in income and savings would push wealth downward by US$325 million. The implementation of SPS on the other hand would have a strong positive impact on GDP (US$694 million) and wealth (US$125 million). These gains are driven by the enhanced productivity of sustainable silvopastoral systems. When comparing the impact of SPS on GDP when ecosystem services values are included, positive economic returns to SPS would be over- estimated by US$53 million, due to the uncounted effects of worsening soil erosion.

The joint implementation of PES and SPS in the COMBI scenario would boost GDP by US$549 million with a relatively small negative impact on wealth (US$22 million). In this scenario, double dividends would be achieved with increased income, consumption and savings through heightened economic activity, coupled with increased natural capital stocks and future ecosystem service flows. In PES+SPSe, where baseline GDP is tracked by endogenous adjustment of livestock productivity, the negative impact on wealth is driven by reduced crop and livestock output which negatively impacts household savings, a key component of wealth.

The establishment of habitat banking outperforms other scenarios across most economic indicators and would boost GDP by US$188 million and wealth by US$1.6 billion. The HAB scenario not only would increase natural capital stocks but would also show some additionality for ecosystem services provision. Comparing the HAB scenario’s performance with and without the inclusion of ecosystem services values, it is evident that ecosystem services contribute significantly to the economy, by US$77 million and US$31 million to GDP and wealth, respectively.

Examining the cumulative value of wealth, PES would generate an additional US$14 billion in wealth. Combined with sustainable silvopastoral systems, wealth would increase by more than US$19.5 billion. Habitat banking again would present clear gains in wealth of over US$16.6 billion. While SPS alone would generate important gains when considering the difference between 2020 and 2040, it does not perform as well from the perspective of cumulative wealth.

The importance of including natural capital and ecosystem services values in public policy and investment decisions is unambiguous. In the case of PES, ecosystem services would contribute an additional US$80 million in wealth. Silvopastoral systems would create losses in ecosystem service- based wealth, on the order of US$295 million. Habitat banking would outperform other scenarios with an increase US$457 million in additional ecosystem service-based wealth.

We implement a benefit cost analysis of these policy proposals using a relatively high discount rate of 12% (used by some multilaterals including the Inter-American Development Bank). When considering household welfare alone, the implementation of PES would result in an economically unviable project with an Net Present Value (NPV) of negative US$293 million (Figure 5). Coupling PES with silvopastoral systems would result in a viable investment with an NPV of US$2.8 billion. The habitat banking scenario would not be economically viable when ecosystem service values are not included, with an NPV of negative US$37 million. When the value of natural capital and ecosystem services are included, the outcomes change. The implementation of PES and HAB would become strong investment propositions, with an NPV of US$4.4 billion and US$4.9 billion, respectively. The joint implementation of PES with silvopastoral systems would result in a NPV of US$7.1 billion, capturing the benefits of both enhanced conservation as well as productivity and rural income opportunities.

Policy Insights

This policy impact piece demonstrates the importance of including natural capital and ecosystem service values in public policy and decision making. If these values are included they can be expected to improve decision making and long-term socioeconomic outcomes through consideration of the contribution of all forms of capital, namely natural, manufactured and human, to sustainable economic development and wealth. Cumulatively, PES and habitat banking would contribute an additional US$14 billion and US$16.6 billion in wealth, respectively, which can help sustain the peace in post-conflict Colombia for current and future generations. These results make the economics of biodiversity explicit and aligned with renowned Economist David Pearce’s assertion that “Economic valuation [of the environment] is always implicit or explicit; it cannot fail to happen at all” (Pearce 2006).

The IEEM+ESM approach is the first integrated analytical framework to endogenize feedbacks between future changes in land use and ecosystem services and the economy, a research challenge posed in earlier work. This approach is critical to account for how flows of ecosystem services have dynamic effects on the economy. It also provides an estimate of the marginal value of ecosystem services, consistent with a country’s System of National Accounts, the primary accounting framework used by countries around the world to measure and monitor economic development. Enhanced ecosystem service flows from investing in habitat banking would generate an additional US$77 million in GDP; this is effectively the marginal value of ecosystem services. This economic contribution is not trivial since in just one year, it would amount to 69% of the habitat banking scenario impact on GDP. Consistency with the country’s System of National Accounts, provides a great deal of credibility to the IEEM+ESM approach compared with welfare-based valuation methods which have been the subject of some criticism.

The IEEM+ESM approach provides critical information to guide spatially targeted policies. Both PES and habitat banking aim to conserve half a million hectares. PES program distribution across the landscape was conducted based on the relative importance of deforestation in each of Colombia’s 32 departments. In contrast, the HAB scenario targeted specific regions of Colombia with high conservation value forests, such as the Tropical Dry Forest, and regions with high ecosystem service supply potential. The result of this spatial targeting was a higher provision of ecosystem service flows in the case of the spatially targeted habitat banking scenario. This provides compelling evidence for increasing the importance of spatial targeting in PES design where the scientific underpinning of many programs is lacking.

Results show just how fundamental the inclusion of the value of natural capital and ecosystem services is in benefit-cost analysis. Investment in conservation through PES and habitat banking is not economically viable until these values are included. The consequences of valuing ecosystem services and biodiversity in economic decision making are far reaching. Results show that PES and habitat banking programs are strong investment propositions (Net Present Value of US$4.4 and $4.9 billion, respectively), but only when moving beyond conventional economic analysis to include non-market ecosystem service values in benefit-cost analysis.

References

Pearce, D.W., ed. 2006. Environmental Valuation in Developed Countries. Case Studies. Cheltenham: Edward Elgar.